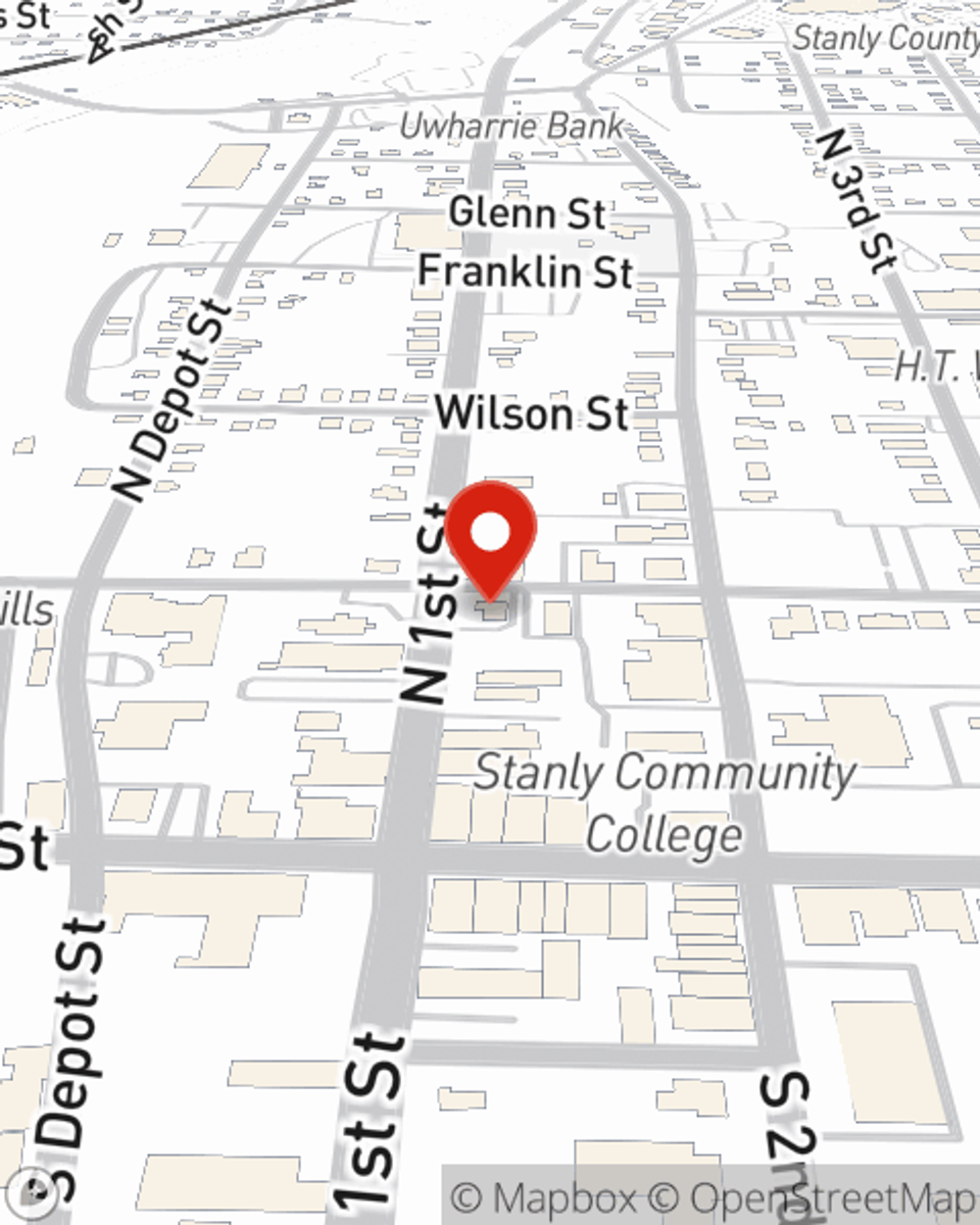

Business Insurance in and around Albemarle

One of Albemarle’s top choices for small business insurance.

No funny business here

- Concord

- Kannapolis

- Salisbury

- Locust

- Oakboro

- Mount Gilead

- New London

- Midland

- Harrisburg

- Mint Hill

- Charlotte

- Huntersville

- Anson County

- Norwood

- Albemarle

- Rowan County

- Montgomery County

- Cabarrus County

- Stanly County

- Thomasville

- Lexington

- Union County

- Monroe

- Sun Valley

This Coverage Is Worth It.

Running a small business comes with a unique set of highs and lows. You shouldn't have to work through those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including business continuity plans, worker's compensation for your employees and errors and omissions liability, among others.

One of Albemarle’s top choices for small business insurance.

No funny business here

Insurance Designed For Small Business

When you've put so much personal interest in a small business like yours, whether it's an antique store, a floral shop, or a gift shop, having the right insurance for you is important. As a business owner, as well, State Farm agent Eddie Wall understands and is happy to offer customizable insurance options to fit your needs.

Call Eddie Wall today, and let's get down to business.

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Eddie Wall

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.